What Inspires Financial Services Innovation?

What drives us to make things better? Why do we push harder to improve a process, a customer journey, to make continuous tweaks to our application interface…what motivates us to think differently and drive innovation? Whether you’re someone on the financial front lines or the founder of a fintech startup, these are your customers, your members, your clients – the ones that make or break your product, your company, your profit and your underlying ability to pursue all of your passions. That’s what we’re doing by innovating in the financial space – helping people pursue their life’s passions by removing friction from our financial applications.

What’s your inspiration to innovate?

First off, a warm greeting from San Francisco! I know we have people on the webinar from a lot of different time zones, so we appreciate your tuning in. I’d like to thank Backbase for hosting this ongoing webinar series. I consider them to be one of the most truly innovative partners in the fintech space, so please stick around for their half of the discussion and to ask questions.

We have a lot to talk about, so let’s dive in.

My focus at Mechanics Bank is on developing our client facing applications, expanding our technology partnerships, and building out our digital strategy. While I’d love to call our bank a 110-year-old startup, I think we’re in the beginning stages of tackling the real technology challenges facing banks like ours – but I am really excited about what we’ve been able to do the past couple of years as our bank has leaned forward into fintech development and innovation. We are working diligently to improve the financial lives of our customers, both through internal development, and through being an active partner and constructive advocate within the fintech community.

I see banks like ours as needing to move beyond a set of me-too applications – we need to push ourselves and our partners to truly deliver something brilliant – something that meets the changing set of consumer expectations and behavior. If you follow me through social channels like twitter, or see my thoughts on my blog or commentary in industry publications , you’ll see my continued focus on working toward this idea of engagement banking – a marketing, sales and service model that deploys technology to achieve both customer intimacy and scale. We’ll look at some examples today.

You’re likely tuning in to this webinar because, like me, you have chosen the spectrum of financial technology as your form of improving the world in your own way. Good thing that fintech never sleeps, that it’s such an invigorating place to be. Especially if you’re in payments, or building out new form of customer experience through mobile. Believe me, there’s room for all of us – as long as we continue innovating and adapting to changes in customer behavior. Because in many ways we aren’t yet solving all of our customer’s problems. At best, we’re close to helping them reach a greater level of financial independence, at worst, we’re setting them back by denying them a better solution.

I heard the term ‘Kodaked’ used as a verb a few times at last week’s Next Bank Asia conference in Hong Kong – I think that’s an apt expression for today’s discussion. Kodak was formed in 1885 and dominated the film industry for a hundred years – at one point it controlled 90% of film and 85% of camera sales. But then it invented the digital camera in 1975 and the rest is history. A good question to ask is how many of Kodak’s employees were users of the very products that caused Kodak’s decline? There are parallels to banking.

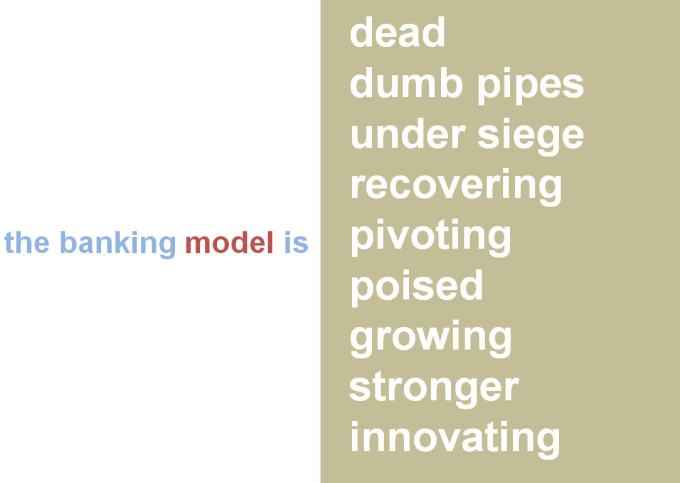

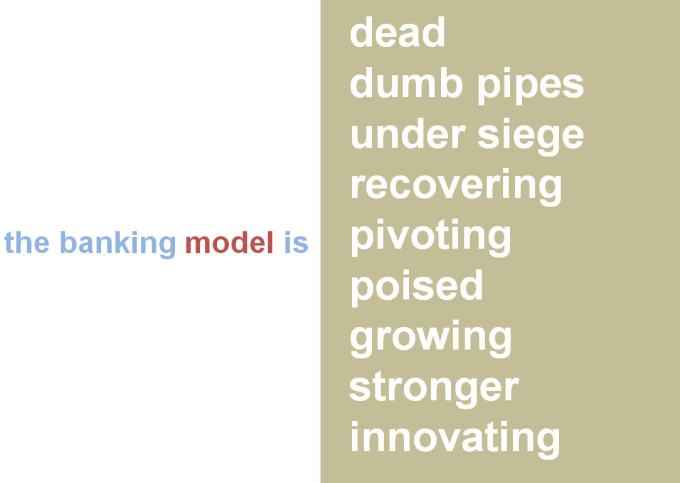

The crux of the argument around the change happening to the banking model is that banks are being dis-intermediated – but I think in many ways the industry, at least certain players, are responding – and in many ways reverse engineering the attacks to its foundation.

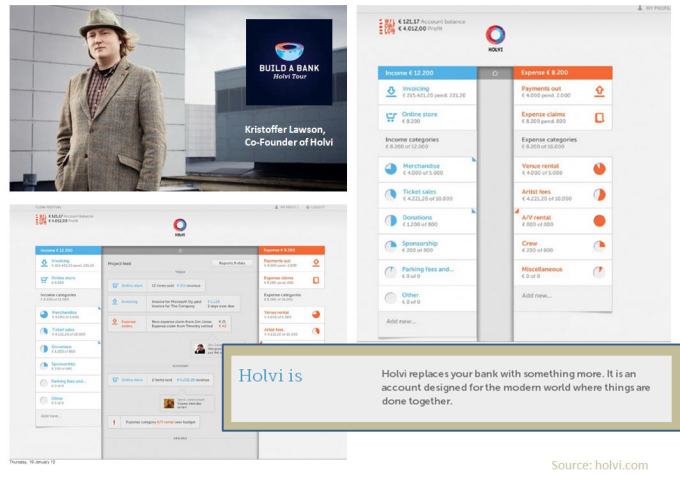

At March’s Bank Innovation conference here in San Francisco, our opening panel was challenged when Kristoffer Lawson, Co-Founder of Finland based Holvi, said that we weren’t really discussing, in his opinion, anything all that innovative – and I would agree with him to a certain extent – but not about what’s going on in the banking model itself. I’ve been in the financial services vertical for nearly twenty years – and the developments of the past few years – from social to mobile to payments – has creaky old banking processes starting to really move. There is quite literally a new development worth talking about every single day. That said, I strongly suggest you visit Holvi and see their approach to interface design and to banking itself – they’ve done a lot of great work around socially collaborative finance.

Holvi’s value proposition is an interesting one. It challenges the role of bank’s in society itself– and it’s reflective of experiments happening through the financial ecosystem, from Bitcoin to Zopa. So what’s your take on the health of the traditional banking model? Is it dying or is it innovating as we move more and more services to digital?

As Zig Ziglar said, ”People don’t buy drills, they buy holes”. And Kodak ignored the hole to protect the drill. So what is the banking model really protecting? As the banking model shifts, are most bank’s even protecting the right holes?

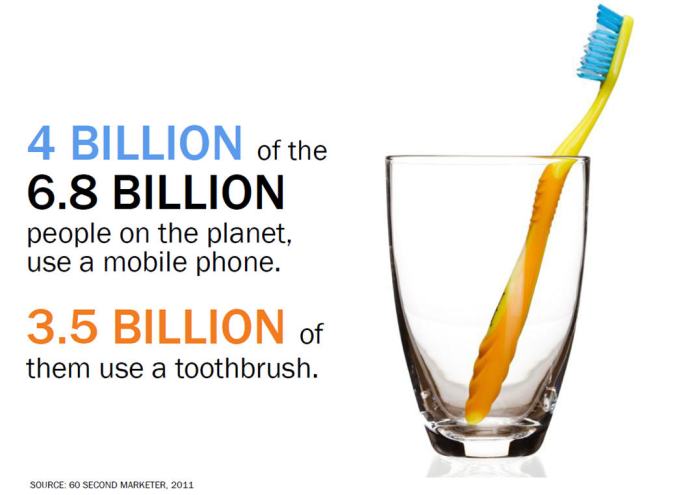

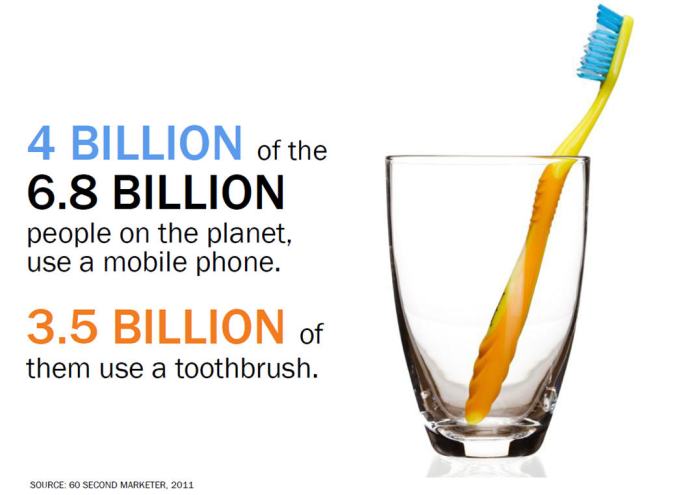

2013, after all, will be the year that there are more mobile devices than people on the planet. While this slide shows an older statistic, the fact that more people have mobile phones than have access to use a toothbrush (or to clean drinking water for that matter), is kind of an interesting development for humans. We now have more computing power in our pocket than what got us to the moon, and yet people still overdraw their account.

Something doesn’t add up.

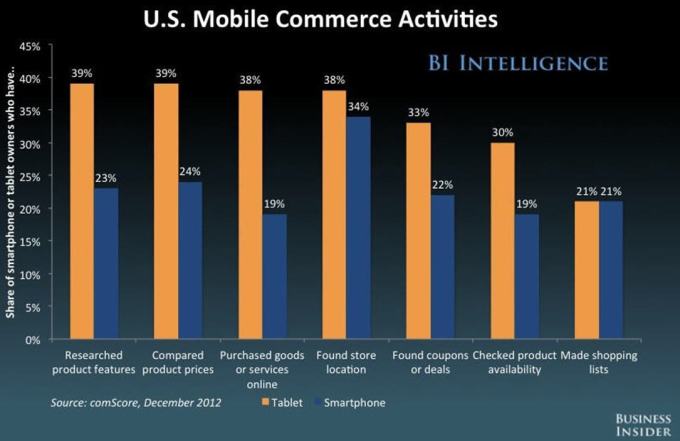

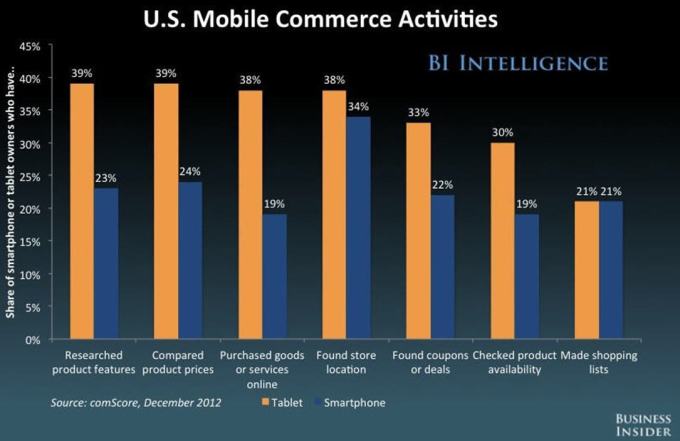

We use our phones for absolutely everything – especially when shopping or doing research for potential purchases before we buy – a critical component of the context for the development of financial applications. When is the last time you forgot your phone? If you left the house without your wallet, would you go back for it? But I bet you do it all the time for your phone.

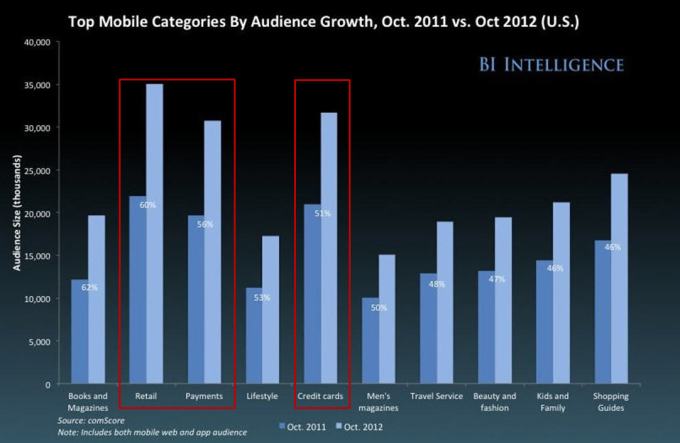

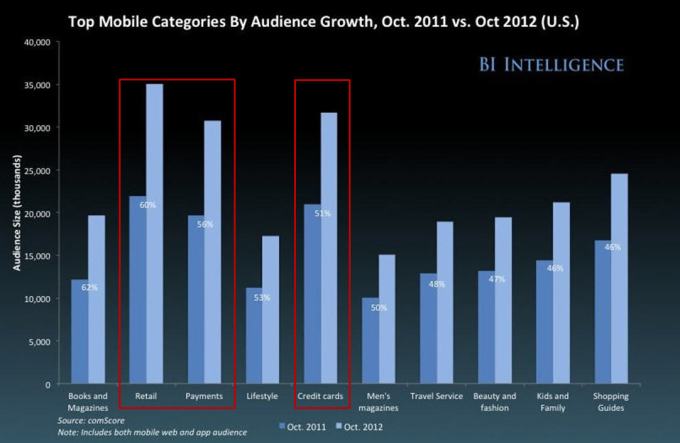

Some of the fastest areas of growth for mobile activities revolve around banking and payment, from retail and credit services to direct mobile payments themselves. Mobile can make day to day banking activities more a more engaging experience – we have the ability to deliver transactions and context at the most relevant point – when the customer is about to use, is using, or just after they used their money.

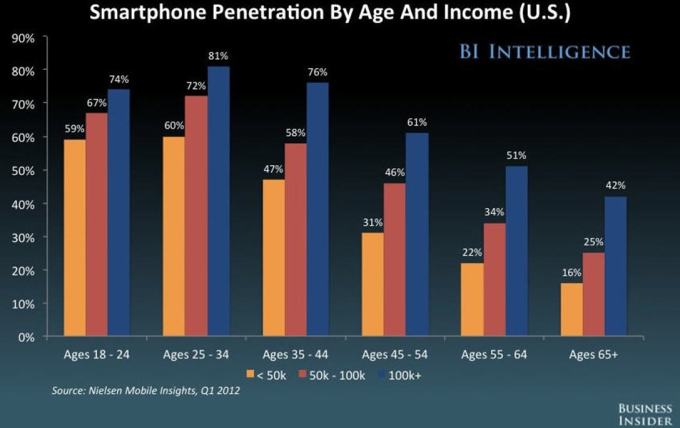

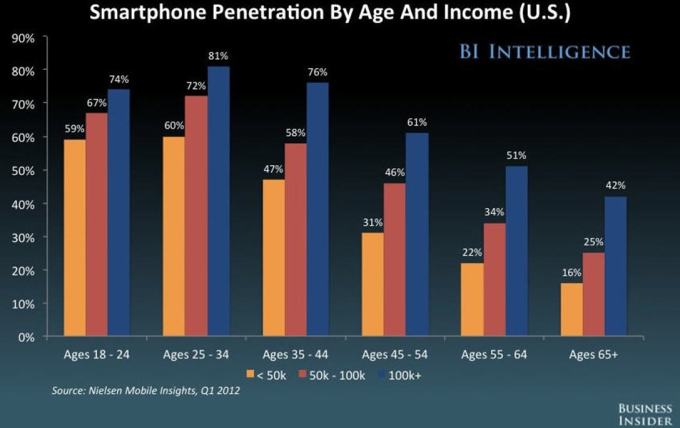

Mobile is also critical to financial application development because of the adoption trends toward younger and more affluent customers. But as we see the development of a digital divide forming, we shouldn’t assume that the underbanked are not engaging with our technology because they don’t have smartphones – I would say they do – it’s more likely our applications aren’t meeting their needs. Look at the rapid rise in mobile focused pre-paid, P2P and location based payments, from GoBank to Bluebird to Venmo to PayNearMe.

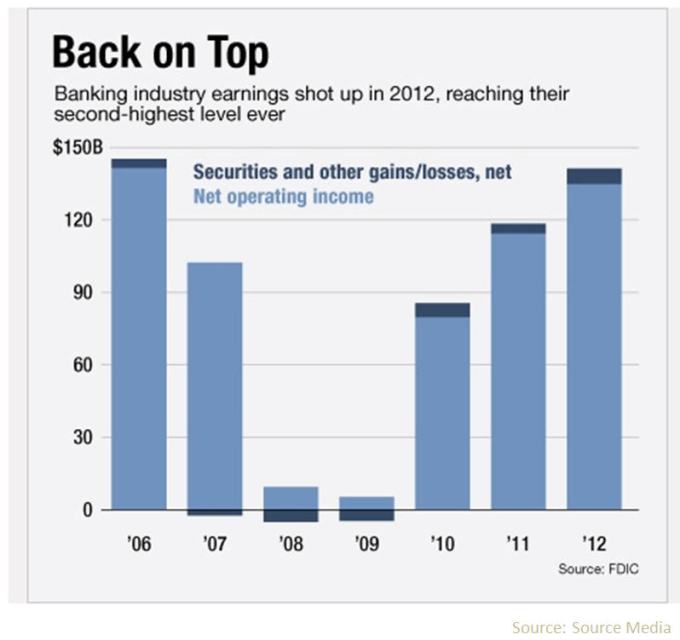

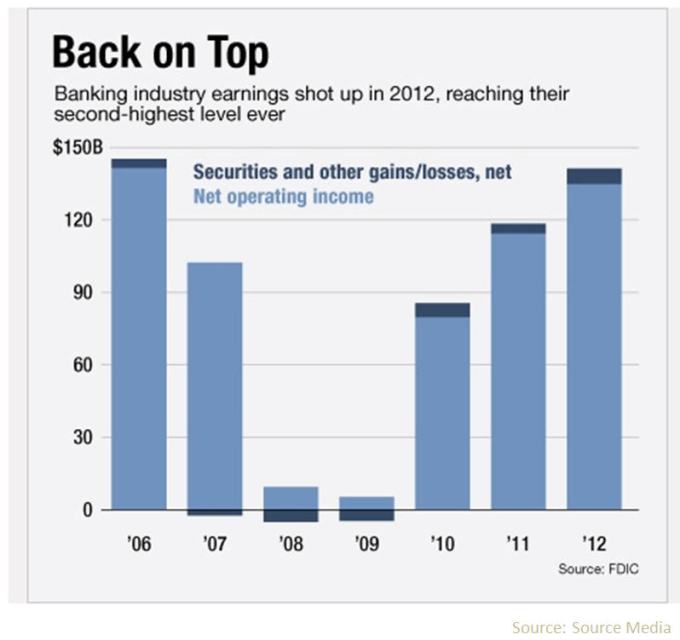

With evolving hyper-connectivity, smartphones and even smarter financial applications, peer to peer and crowd funding, open source banking fueled by the rise of non-banking partners integrating through APIs, the friction of day to day banking transactions is being removed – most often by players outside the banks themselves. There are not many areas of banking that aren’t going through significant change…and it’s having a pretty dramatic impact on the industry itself – although you wouldn’t know it by looking at one key stat.

Banking income is on the rebound – the industry recorded near record profits for 2012. Some of the post recession growth is a reflection of changes to loan loss reserve, security gains and losses, rebounding mortgage activity and efforts to gain efficiencies.

So what does this mean for the industry going forward?

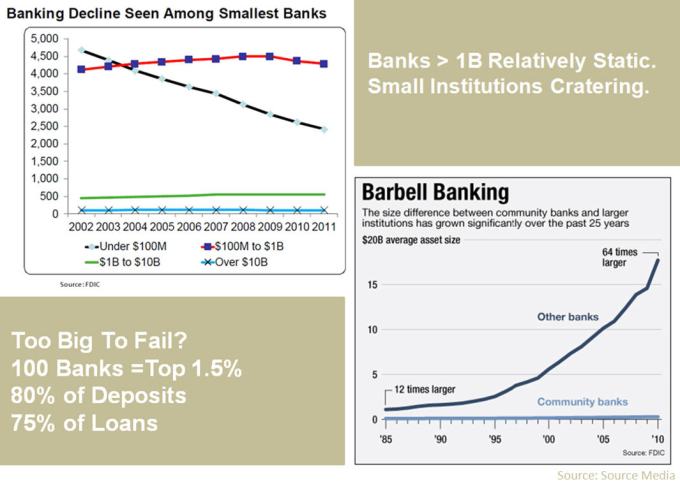

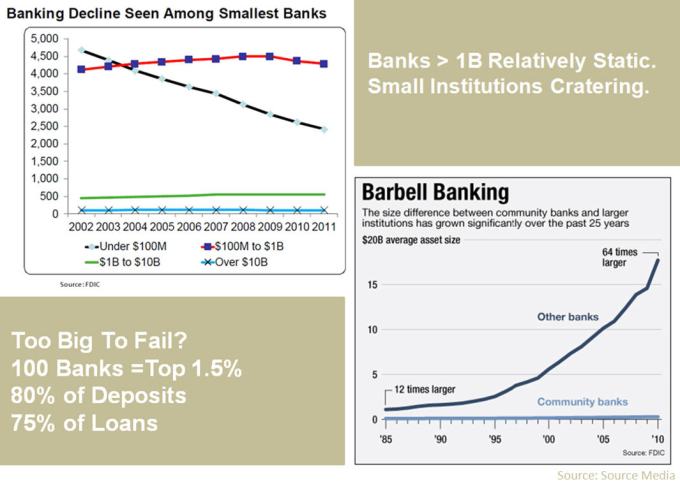

Despite near record profits in 2012, most of the growth is driving further consolidation and contraction within the industry. It could be that as we move from 14,000 financial institutions down toward, say, less than half that in a decade, the new safe zone for economies of scale moves to 10 or even 15 billion in assets. The imperative to grow, to embrace this digital transformation, is really about survival.

Our competition – from large players to startups – have to be licking their chops, thinking of areas where they can continue to nibble at our revenue streams, from changes in the lending model to the competition in payments…but overall, banking, despite its challenges, remains a lucrative industry with large embedded players that are starting to mobilize.

So, what are we doing with those record profits?

Some of us built fancy new branches…

And deploy really big tablets in them …

Maybe make them feel like our homes or our offices…

Or like the Starship Enterprise…

Aite Group’s Ron Shevlin had this message for bank’s focused on building out that Apple retail experience in their branch networks – I hope that works out better than it did for JC Penney.

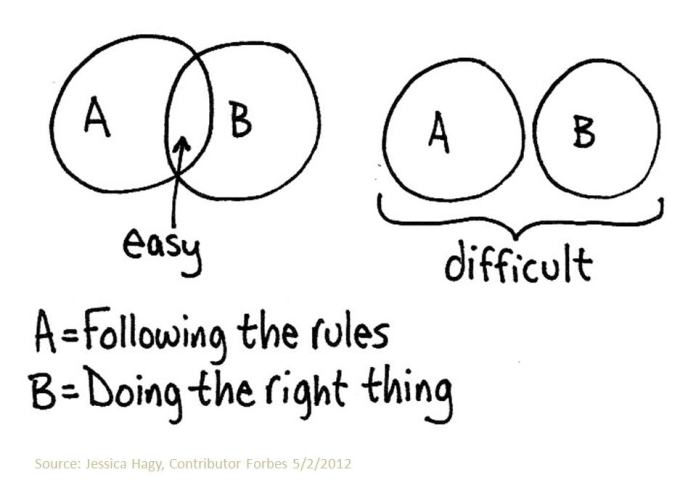

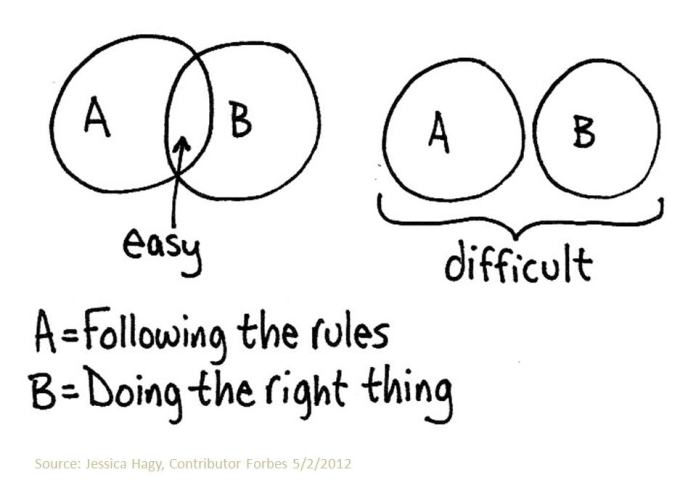

I hear this from my peers quite frequently – driving change and innovation inside a financial institution can be painful, even hazardous to your health. We’re not agile, we’re over-regulated, and our decision making and processes are bloated. Stop with the excuses already. Are we so afraid of risk that we can’t move to improve our technology and services to better our customer’s financial lives? Sometimes innovation simply means getting things done as Sam Maule from the Carlisle and Gallagher Consulting Group. Let’s break new ground because I think it’s worth the effort to tunnel through granite.

Ron Shevlin asks a key question – why don’t banks innovate? Why haven’t we seen large-scale, transformational change — or innovation — in the industry? Because — until recently — there has been no need for the industry to change. The elements of change simply weren’t in place. Ron goes into recent changes in technology, demographic shifts toward Gen Y and Millennials, and finally into a convincing dialogue around the changing economic equation driving the revenue model – he concludes that “we may actually see some innovation in the industry over the next few years. It’s not like the banks are too stupid or don’t how to innovate. They haven’t had the economic imperative to innovate. Until now.” I highly suggest you follow Ron’s work, both at Aite and on his industry blog.

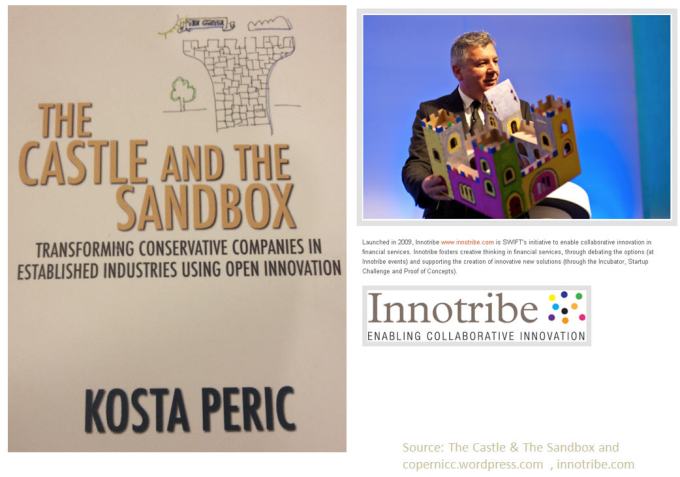

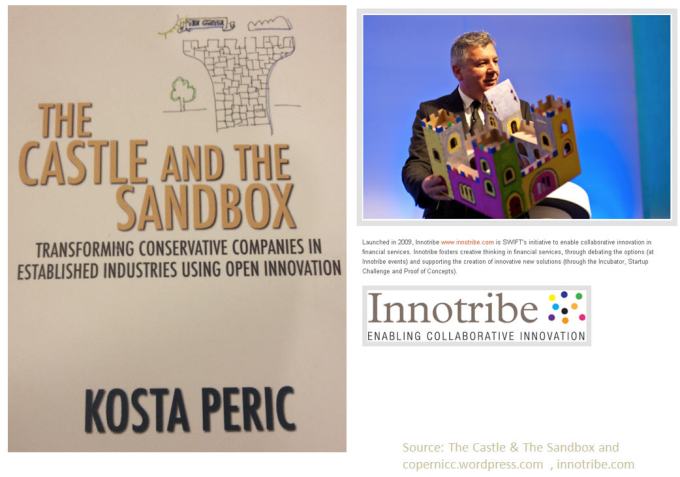

How do we provide a safe framework for innovation in large financial organizations? While there are some good examples from throughout financial services, from innovation labs, startup incubators and accelerators, from Citi Ventures to Amex to Capital One to Discover, sponsored meetups with developers with Silicon Valley Bank and others, there is one example I am really drawn to, and that is from SWIFT’s formation of Innotribe in 2009.

Kosta Peric, co-founder of Innotribe tells a fascinating tale in his book the Castle and the Sandbox about how you can transform conservative companies using innovation – it’s a great read and is highly recommended. What are the concepts around Innotribe?

Chris Skinner provides a great description of Innotribe – a small viral spacecraft that helped spread a new species called creators – the people within the organization that help transform the culture of a larger structured financial organization by initiating change, new ways of thinking – Innotribe acts like a startup inside its larger parent – making its parent act more quickly to the changing environment.

The book explains that if the core business of an established company is the “castle” (well protected and built to last), innovation is best carried out in “sandboxes” – environments outside the castle where experimentation with new ideas and concepts is easier. The idea is to then bring these experiments back to the castle to make it stronger. How do you do this? Find the intrapreneurs inside your company – find those people that have patience, perserverance, and passion. Having just helped judge some of companies that entered Innotribe’s 2013 StartUp challenge, and being fascinated by their disruptive incubator project centered around digital identity (the Digital Asset Grid) led by Peter Vander Auwera – I can report that Innotribe’s approach to sparking innovation is alive and well. My hats off to the Innotribe team on what they’ve achieved – I highly recommend Kosta’s book. …

One of the more interesting things from Walter Isaacson’s book on Steve Jobs was his penchant to take long walks with people and just talk about subjects that mattered to him. Let’s take a little walk of our own as we imagine what banking would look like from four of the most influential technology providers.

While seemingly going through a rough patch now (are they the world’s largest company today? Ask that question again after the next iPhone launches), Apple is a force of innovation unto its own. While Google may be winning mobile platform market share, the real money being made in mobility is going to Apple – from the sale of the devices themselves to the battle of the app stores to the success of their retail efforts. We owe much to Steve Jobs and Apple for innovation in design and process – if they were a bank, I think we would see them incredibly focused on the customer onboarding experience, simplification of security, flexible payments, engaging product delivery from retail to app to online, and on the customer – merchant relationship – and we might see this focus come to the forefront as the rumors of NFC and biometrics emerge as part of the new phone release. I’d love to see more excitement and attention to the customer as we launch financial products as we see in an Apple keynote. In many ways, I’d compare them to the big five banks because of their size – but in the end Moven and Simple make better comparisons because of their dedication to the user experience. I personally don’t think Apple is anywhere near done innovating.

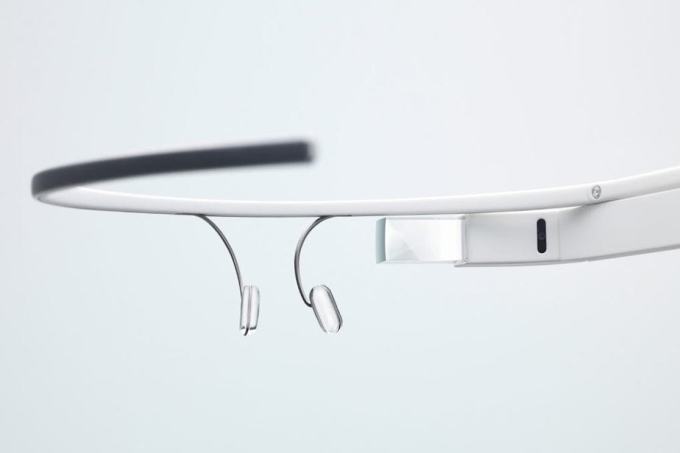

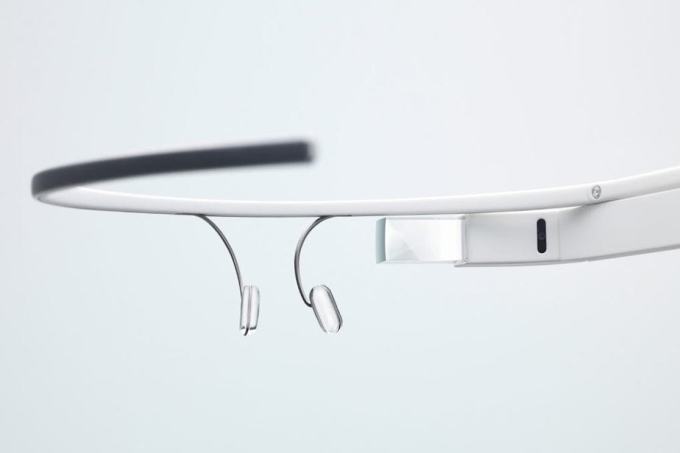

Google is perpetually experimenting, dominating critical digital infrastructure like search and now mobile OS development. As they move into driverless cars, extending internet connectivity through Google Fiber, breaking new ground through a project like Google Glass – they show they are concerned about remaining relevant and making 10X investments. A bank like Google would be forward thinking and be planning out massive infrastructure investments that would pay off in the long term, a bank like NAB in Australia or a USAA in the States perhaps. As Google goes about collecting every inch of data from the digital spectrum , they are working on new ways to monetize that data. We start seeing that information itself is really a commodity- Insight from that data is what is the most valuable thing. So it’s not about big data – it might be about providing the minimum amount of information required to help a customer get the appropriate results in order to take action. Big data becomes small, personalized to the nth degree. Here are a few examples.

Banks have been working to best leverage transaction data for decades. Historically we’ve used this data to model financial and insurance products and then now more and more consumer items with Truaxis (now MasterCard), Cardlytics, and Bankons (now CapOne), and card linked offers through companies like Cardify. We’re seeing offers popping up within online banking, within locationally aware mobile banking applications from Intuit and Amex, from Foursquare to Capital One. But how can we refine these offers? Focus on creating less friction by demonstrating that you know your customer’s data and their needs – create a better value exchange. Since there’s a fine line between being influential and being invasive, our focus might be on providing options to record customer taste and preference – perhaps providing options to tap into their social graph – this way we can focus on delivering more effective offers in the proper context. But there is much more to this.

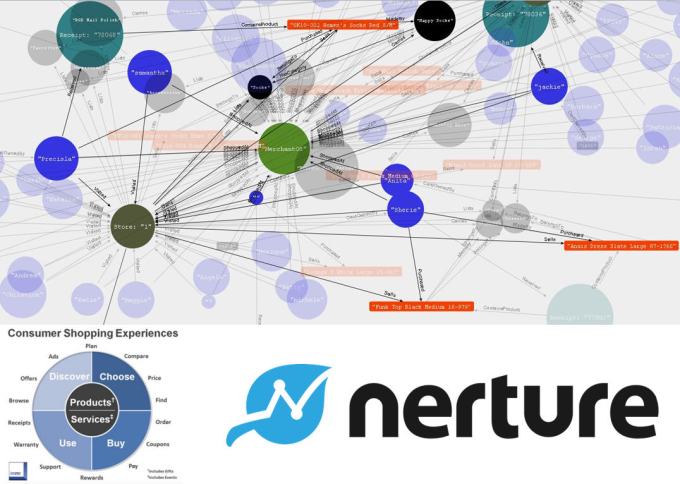

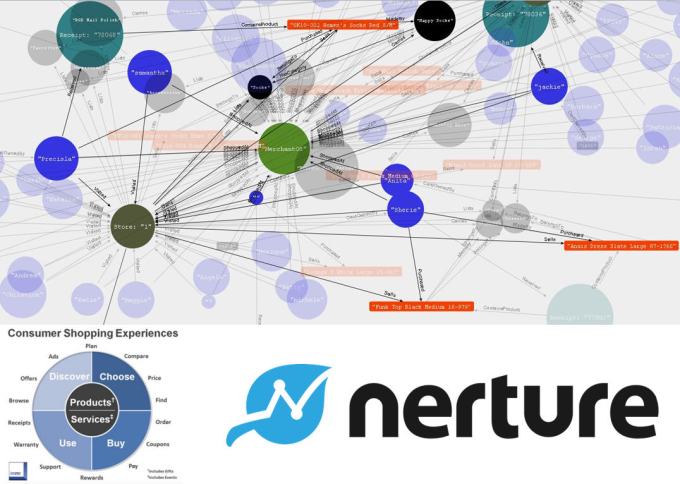

Enter Nerture. This company combines online and mobile search data with transaction data – and, get this, they have found the secret sauce to provide tier 3 or SKU data to its partners – that’s itemized receipt level data to you and me. Imagine what you can do with this amount of context – you know what the consumer is shopping for before they buy, whether it’s a car, a concert, or a vacation, and then you can provide assistance or offers in order to deliver the most appropriate service to your client in the most appropriate time and context. And then you have the ultimate prize – proof of purchase down to the product SKU level. But this data isn’t just for marketing, it can provide even greater refinement to value driven services to improve personal and business financial management tools. How much did I spend on groceries the past quarter? Can’t I buy those non-perishable items like toilet paper and peanut butter from another source and then save more for that vacation? Now you can the idea. Nerture is still forming its business model and is in active discussion with industry players – please contact me if you are interested in learning more. The possibilities are engaging indeed.

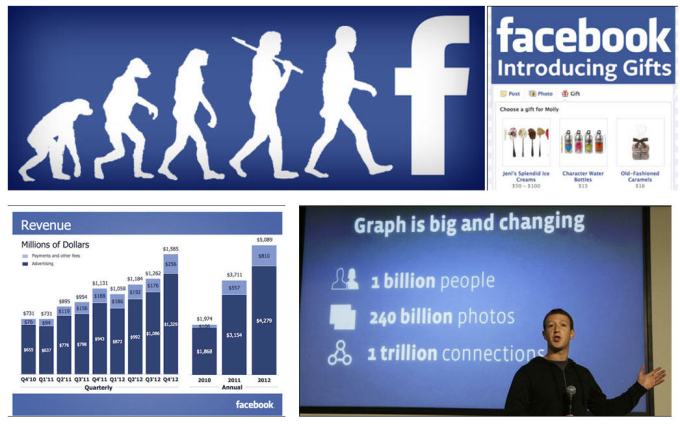

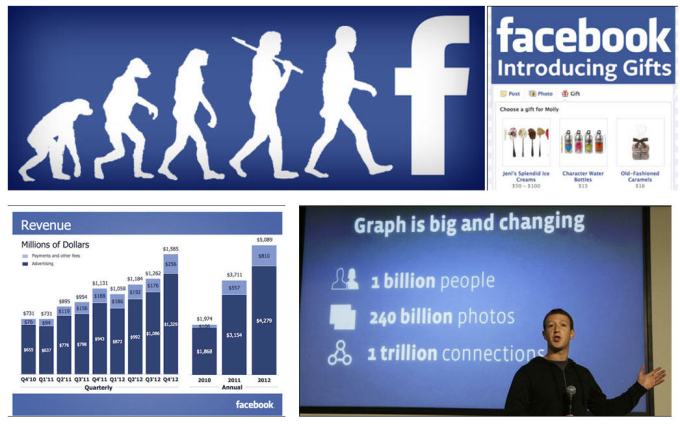

Facebook is the 800 pound gorilla of social – while not the first, it is and will continue to be the biggest social experiment in human history. That is, unless the next generation rejects its use of personal data once and for all and moves on the next big thing. If Facebook were a bank – we’d be worried about our transactions appearing as ads – or about large scale changes to privacy policies – can you imagine the fun they would have with the FDIC, FFIEC, or the CFPB? But Facebook is an experiment, and so you have to sit back and learn from the ubiquity of social sharing and appreciate the ongoing willingness to alter the user experience for a billion people – most recently with Facebook Home – demonstrating an amazing ability to reinvent itself for mobile in less than a year’s time. It also shows us about their drive to shift new experiences on top of a mobile OS – to bring front and center content, notifications, and activity – whether we want it or not. Fidor from Germany is the bank comparison that comes to mind – the bank that defines itself as a community and drives social banking innovation. This philosophy extends right through to its motto: ‘banking with friends’.

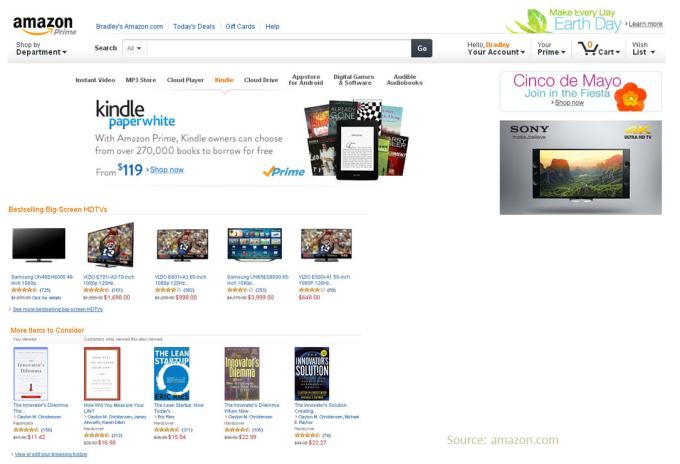

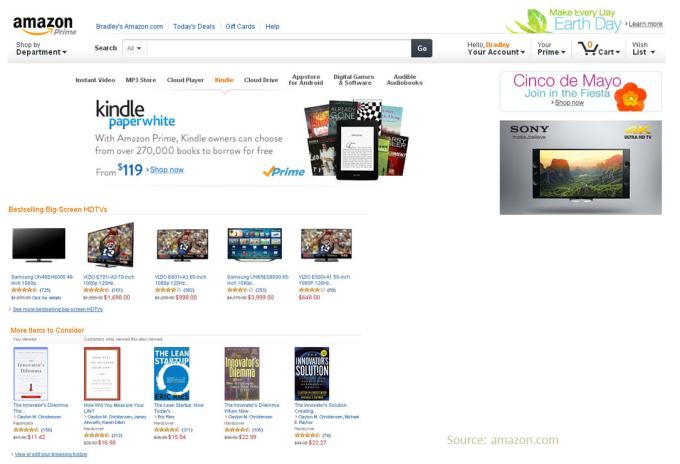

Amazon is the world’s largest marketplace. While you might describe Amazon as the world’s biggest personal shopping mall – I would suggest that it is the largest repository of interesting data next to Google – it’s where we first saw the mass experiment of reviews deployed, as well as the culmination of personalization driven by algorithm, combining a Pandora-like crowd source of recommendation that drives an incredible commercial engine. Comparisons in my mind are to credit card giants like Capital One, Amex, and Citi – or even the large payment networks themselves like Visa and Mastercard which combine worldwide card activity and analytics for effective cross sell and micro-personalization – something all banks need to master. Also known for placing big bets – like with the Kindle – Amazon is building a 10x organization focused on long term customer value. Are we selling products in similar ways?

Seth Godin says: The goal is not to find customers for your products, it’s to make products for your customers. A customer simply wants to send money to their kids at college. Or they want a new car, a new home. Or to take a vacation once a year. In comparison, we sell them products, not dreams, not the end result. Maybe we need to be better at communicating the value that banking brings to the needs of our customers – we’re sometimes not the best storytellers in regard to our own services – especially through digital. But I’m getting a little ahead of myself.

Many of us are locked into partnering with the established ecosystem of large fintech players who have primarily focused on further developing online banking during the past decade and are now playing catch up to deliver applications designed to reduce friction through mobile financial engagement. Tell me why I can do more in an online browser than through our mobile applications? It’s a four screen world across two primary application schemas, and whether through native applications (my preference), or HTML5 development, we should develop for application consistency across channel – leveraging the best design for each devices. That’s easier said than done. But it should be our primary goal as we fight for relevancy.

And you might argue that we’ll see a fifth and sixth screen soon – if Google Glass and other wearable devices like watches creep into our daily life. Ukrain’s PrivatBank is already planning banking apps to use Google Glass – so how long will it be until building apps for more types of wearable tech is the norm? I look forward to automating my family’s grocery needs as our refrigerator talks to other connected devices throughout our house and then advises our financial accounts to deliver groceries as needs arise. We need to have flexible development processes and agile partners in place to meet the changes in technology and consumer behavior.

If the internet changed the way people find, discover, share, shop, and connect, then this trend toward mobility simply escalates this trend. From the growth of mobile applications devoted to social connectivity and discoverability, to the sharing of photos and other content, mobile financial development is simply hanging on to the coattails of broader development and design trends that best leverage location, big sets of data, and levels of engagement.

I raise some eyebrows when I say that you could probably start a bank with IFTTT (If Then Then That), Stripe, and Twilio. For a very basic application, you can create the application wrapper, add actionable alerts, the ability to move funds around, and an option to talk to somebody when something goes wrong. This really talks to the rising importance of the API ecosystem and our options in building financial applications as we open up our platforms – we have so many more options today. So what is the new face of mobile then? From a quick balance to payments, from virtual assistants to contextual offers, what should we be focused on as we build mobile financial applications today?

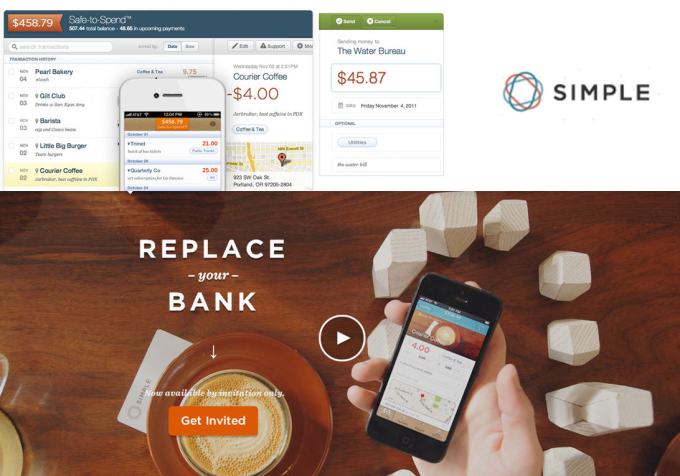

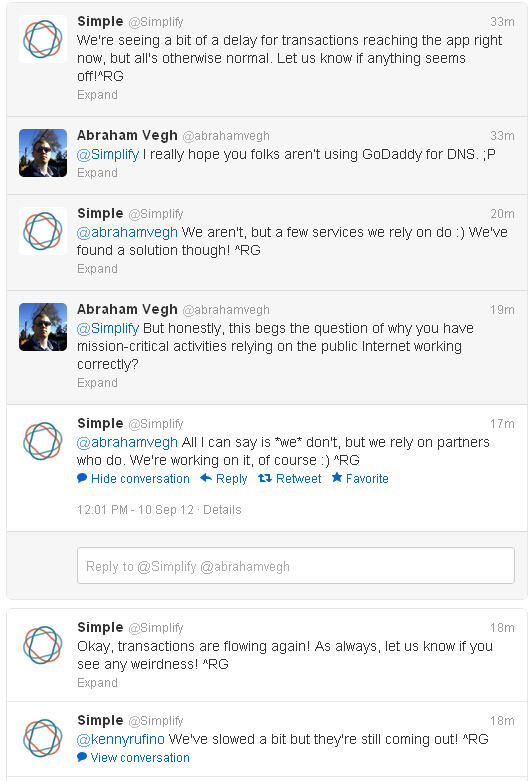

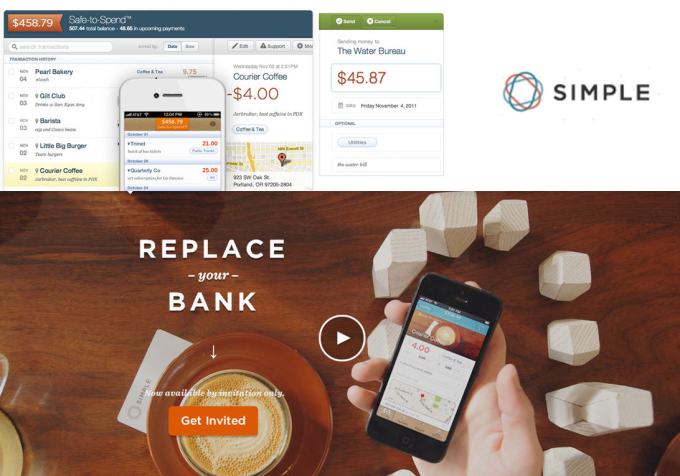

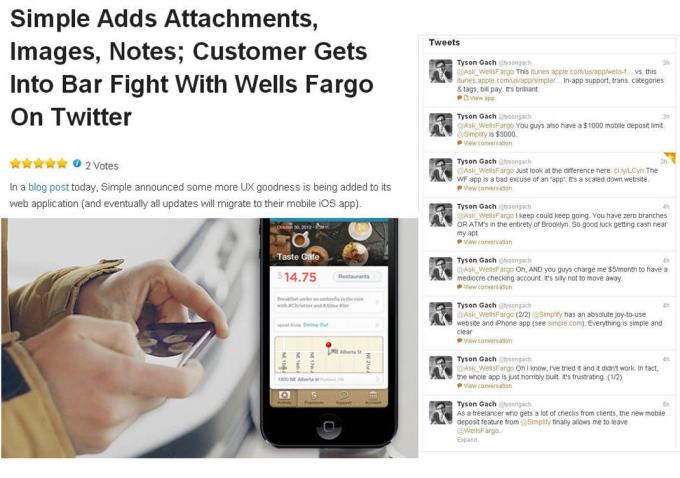

Simple is a good place to start. From Safe to Spend to the card lock/unlock to the image/receipt attachment to the social engagement with its customers. It’s simple, instant, and personal. It’s about ‘perceived simplicity’ for customers – not about simple products. To know what that means, you need to know your customer. There many lessons here from Josh and Shamir’s team.

One of them that I take seriously in our development is the trend toward personalized visualization – from Pinterest to Summly to Flipboard – people want their content personalized and presented in a beautiful format via mobile and tablet and web – this should mean financial transactions as well. How are you helping customer’s data tell a story when you don’t let them personalize it? They also have customers that work hard to promote their services – this one picking a fight with Wells Fargo on Twitter – one of my blog’s most read posts of 2012. But that’s a whole other story. Simple just gets it. I’ll leave it at that.

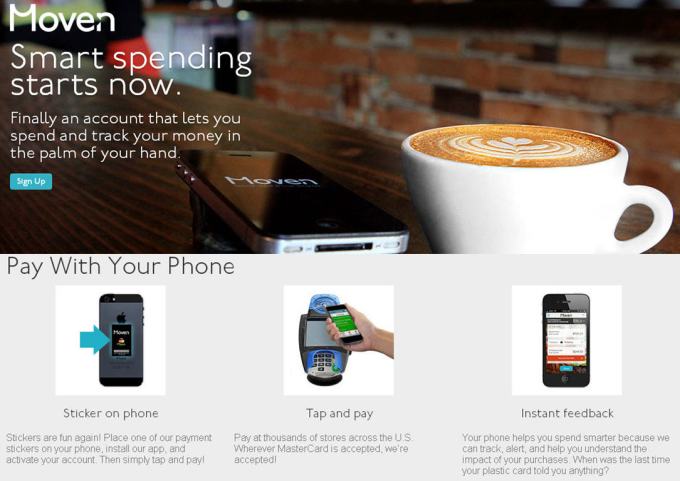

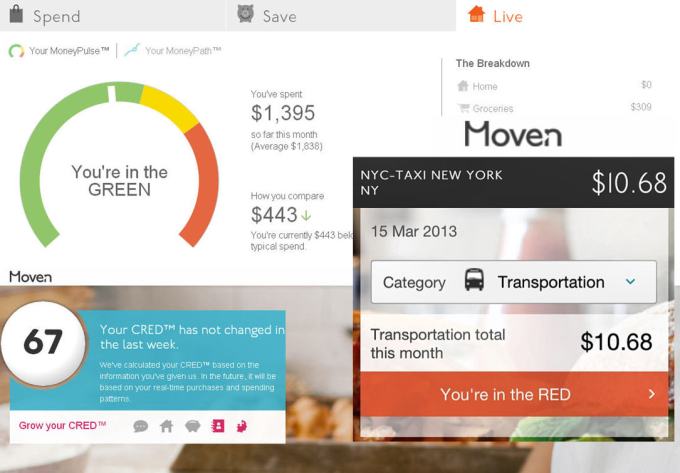

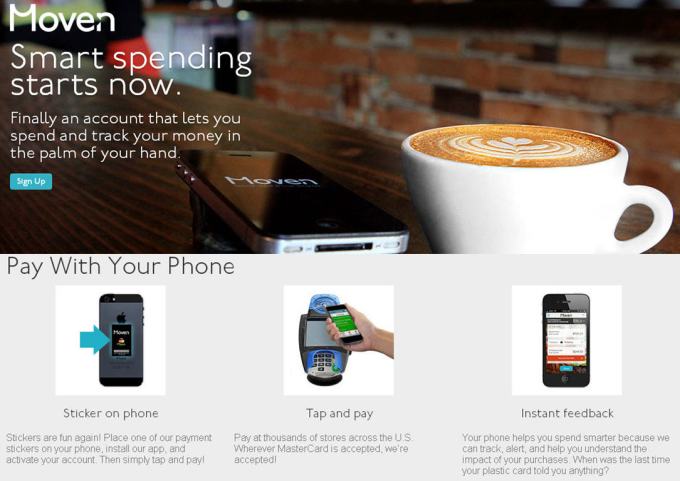

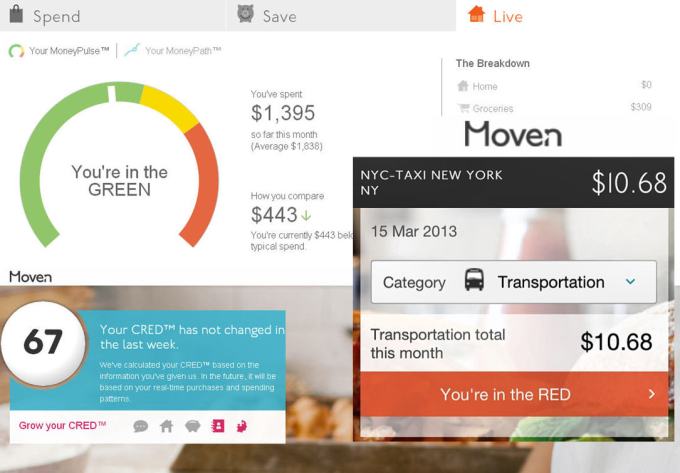

Moven unveiled its solution at Finovate Europe in February. What Brett King and Alex Sion are doing at Moven is providing a way for consumers to think about banking differently – built from the ground up as a mobile only banking service, Moven relies on NFC payments and continuous transaction engagement to help people really improve their financial lives.

Having met with Brett King and Alex Sion last week and seeing Moven’s instant receipt categorization in person, I can tell you there are a lot of things Moven is doing that need to be looked at – from the transaction level engagement to the interface design. This is just fantastic stuff.

Whether on mobile, tablet or browser, Money Desktop continues to demonstrate how we can build applications to change the linear way we look at banking transactions today. This is a simply a more engaging way to look at your budget. My hats off to the team as they continue their success in 2013. Beyond budgets, you’ll probably need some additional financial advice.

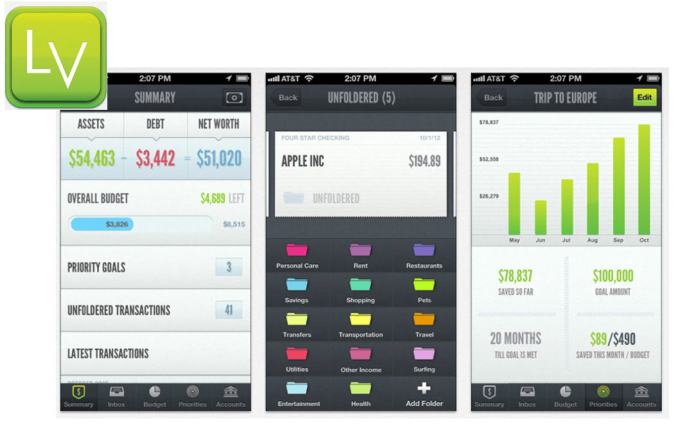

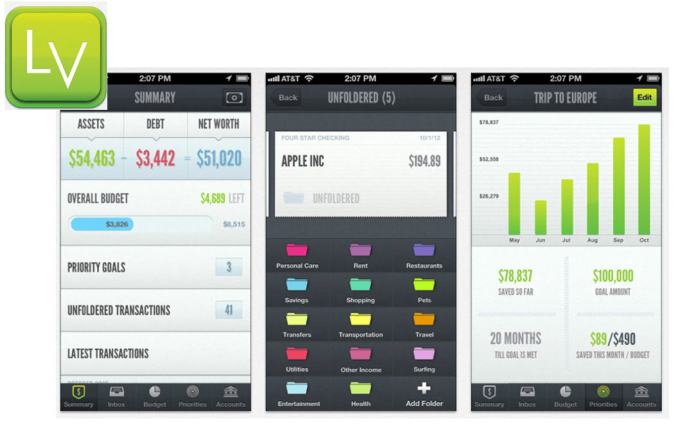

LearnVest adds an interesting feature by not only aggregating your financial data around the concept of long term goals and investment options, but by having you treat transactions like email – something that needs to be dealt with to reach transaction zero – through foldering the data. While possibly more time consuming than categorizing transactions as they occur, I like the idea because it mirrors applications that are trying to simplify both email and calendar data (think Sunrise, Sparrow, Mailbox).

Personal Capital does some similar things to LearnVest and adds A2A transfers, and direct connectivity to a personal advisor through Facetime. We’ll likely see a lot more of this direct to advisor application as we close more physical locations.

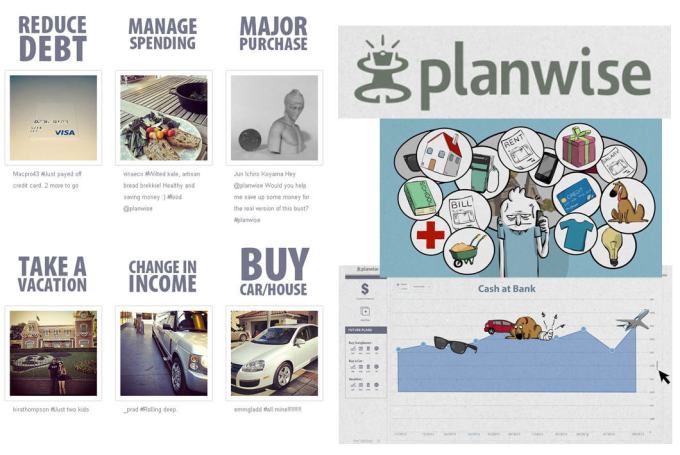

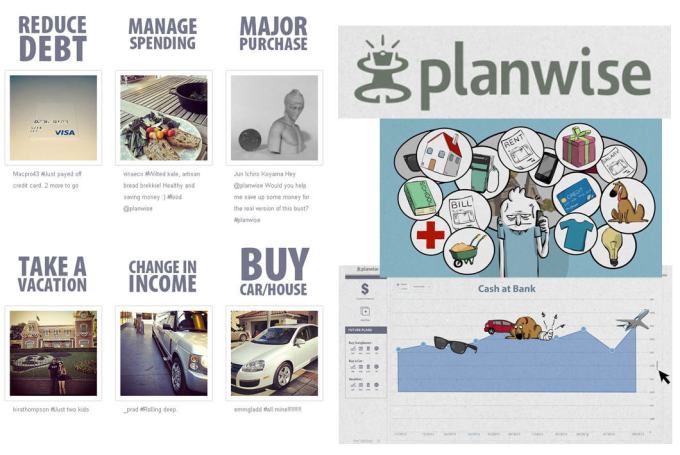

San Francisco based Planwise takes an outside in approach to money management with engaging interactive tools that walk you through a path toward your financial goals and how your decisions impact them. They have a great team focused on this interesting advancement in financial advice and planning. There are some other ways to further personalize financial data.

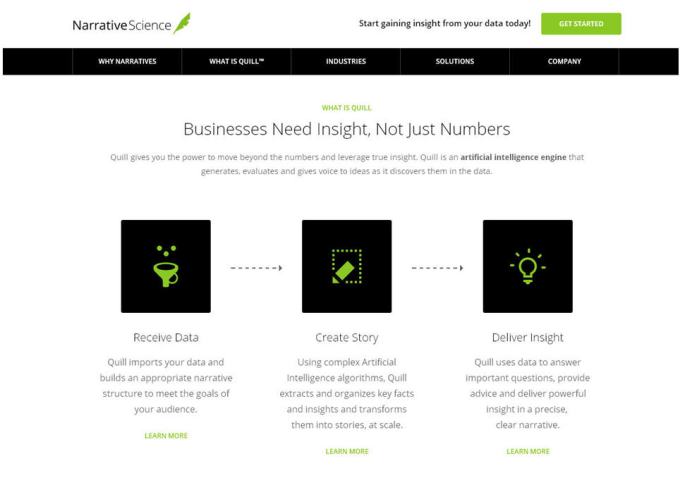

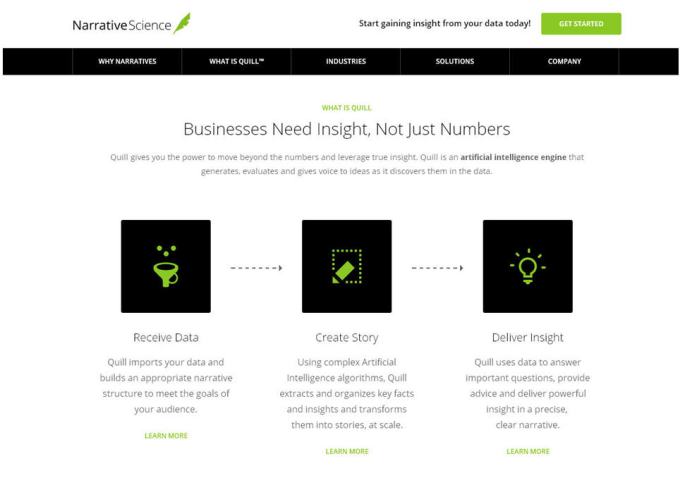

The concept of big data is meaningless unless we wrestle meaning from it – a company called Narrative Science is working within several verticals, and in financial services with Personal Capital, to leverage data to automate a narrative, to personalize what data means at the individual level – its content for an audience of one but at scale. Their service, called Quill, takes large sets of data and delivers a narrative about anything from a day’s worth of financial activity to what a person’s portfolio did in the market that day. The engine will generate personalized stories for mass affluent users, who link an average of 16 accounts to the service. I think we’ll see more banking applications for this technology in the years to come.

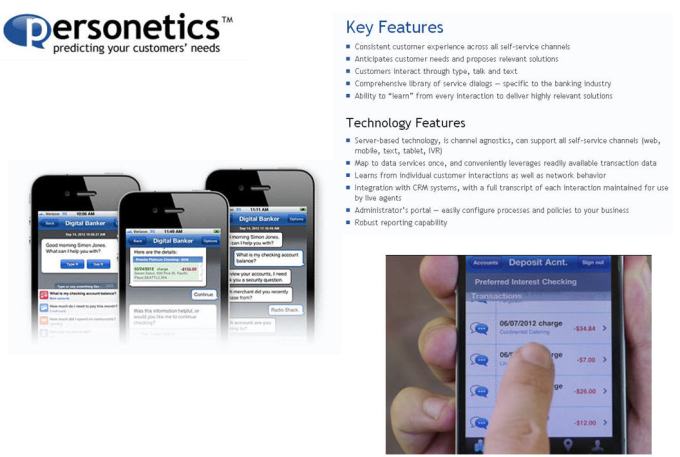

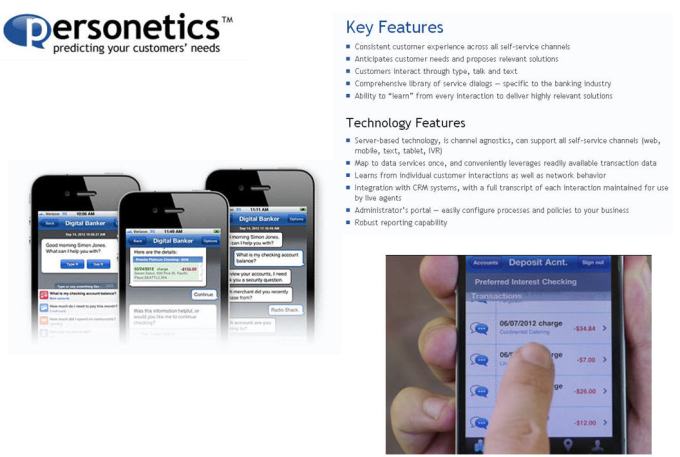

Knowing what your customers want before they even ask and being able to solve their issues quickly. That’s power. So what if every banking transaction contained a quick link to intelligent contextual assistance? That’s what Personetics delivers within online and mobile applications, leveraging tap, type, text or voice interaction with customer data. What is this transaction about? Where did it occur? Why was my payment this much? How much did I pay last month? Personetics has an interesting solution worth checking out.

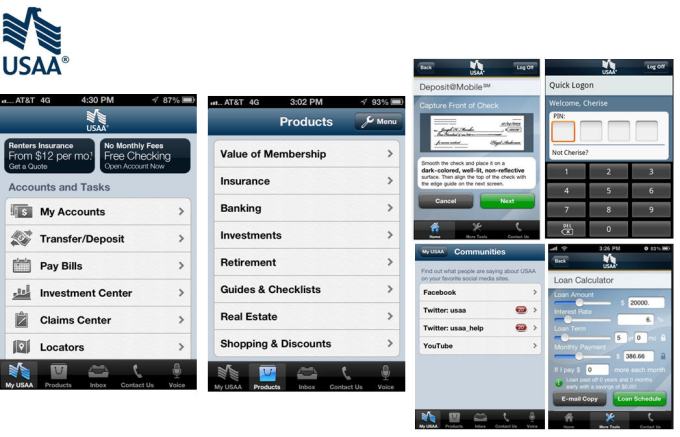

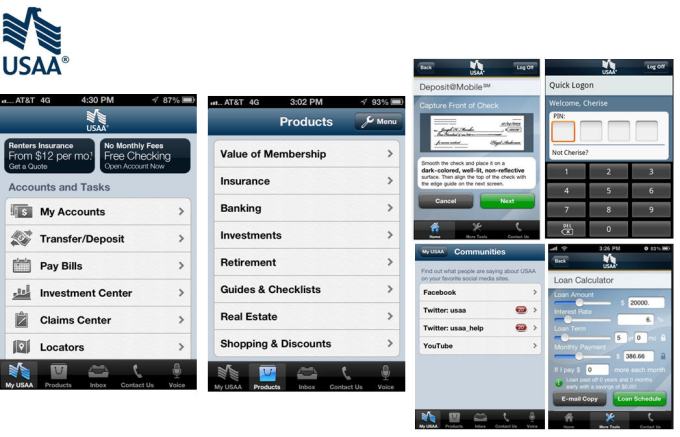

Often referenced as one of the most innovative banks, USAA’s mobile application is like a Swiss Army Knife – it has just about every tool you need. On my own mobile must-have check list, it has a quick login option, extensive product cross sell, a claims application that assists you in recording details of an auto accident, as well as industry leading RDC, product calculators, and a few great items like A2A transfers and social integration. But there’s even a few more hidden gems.

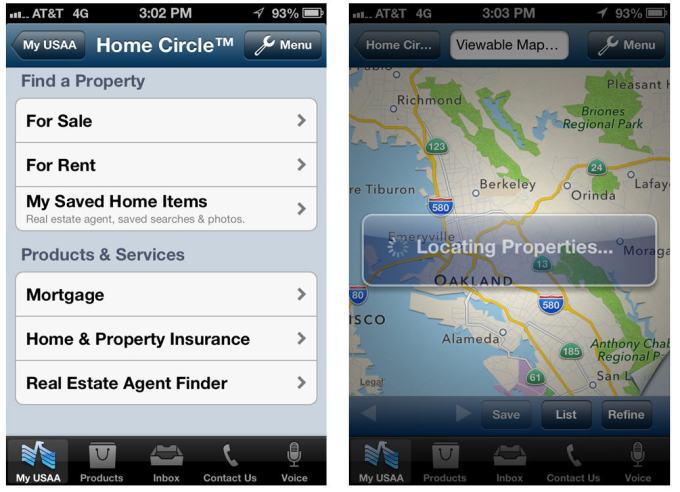

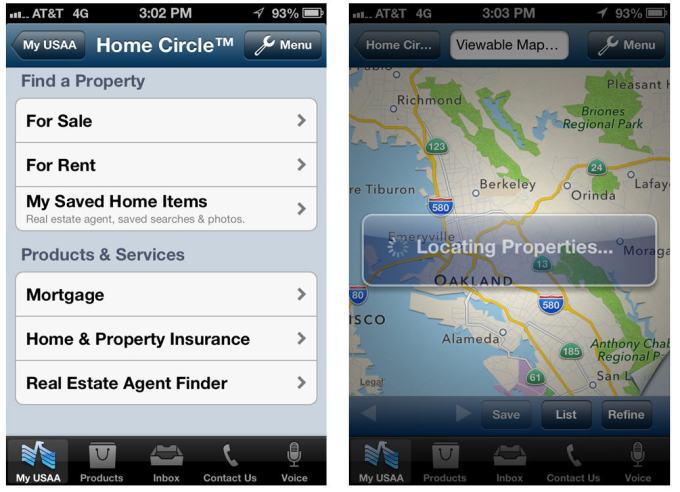

Looking for a house or car? USAA has the most extensive in-application data I’ve seen to assist their members in researching these larger purchases. Think of it as a cars.com and zillow right right within mobile banking. And these services are even better on the tablet.

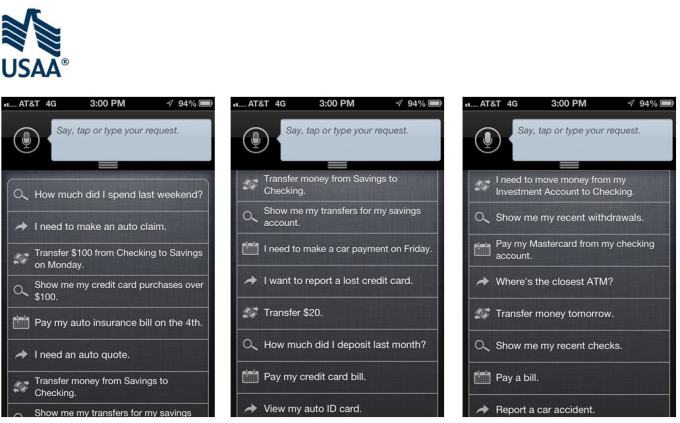

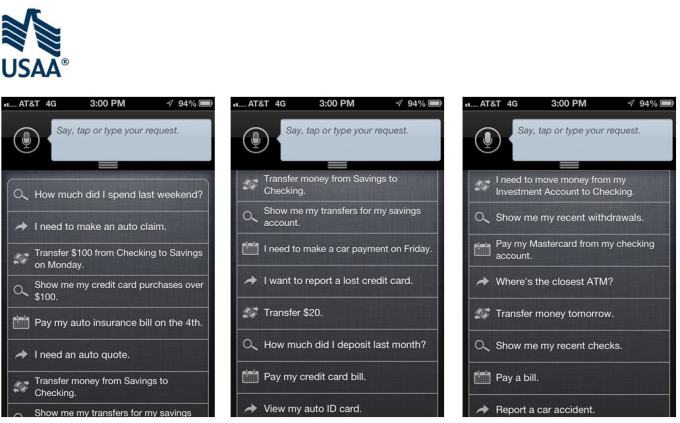

There’s one more thing.

USAA just launched voice banking. Have you ever used Siri or similar services to make a reservation or place a call? Enter Nina from Nuance. Like Siri, Nina can send texts and emails, do a web search, and get directions. But Nina can have “continued conversations with contextual dialogue with a user”. That means it can hold a conversation.

I think USAA is going to remain a technology leader for some time.

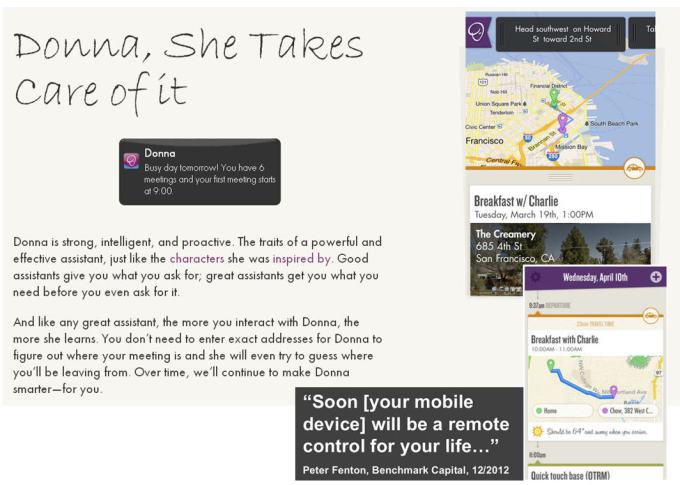

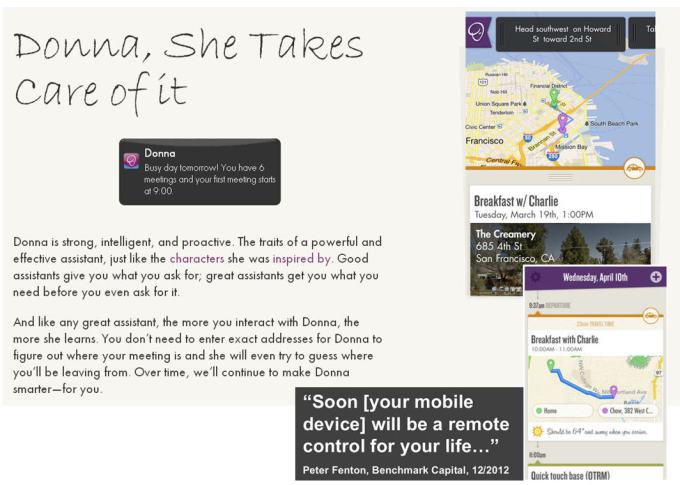

While we’ve looked at some interesting developments, are our applications engaging enough? Why should we want to play Angry Birds more than engage in our own finances – the very thing that enables our ability to pursue those things that most matter to us? Personal assistant applications, like Donna above might waken us up to tell us the events impacting our financial picture that day, as well as a summary of our progress toward our goals. That’s what we’re working toward – meaningful, contextual, intelligent applications designed to improve our financial lives.

There’s are key differences between Wall Street banks and Main Street banks, between national banks and regional banks, from American banks to international banks. We all have different structures, different scale, different scope and different values. I’m not sure I’m ready to give up the mantle of respected financial partner to startups or payment providers, but I’m more than willing to partner with them. Taking no risk is the greatest risk of all. If innovation still means delivering continued value through new customer experiences, then count me in. I hope I can count on you as well. I thank you for your attention today, and I look forward to additional conversations as we connect through the fintech community.

This post comes from my April 2013 Backbase Webinar. You can view the webinar and download the slides at that link. Let me know what you think.

About The Author

Bradley Leimer, Vice President, Online and Mobile Strategy at Mechanics Bank and financial technologist and engagement banking proponent discusses customer behavior and related design trends impacting financial application development. He explores topics that are relevant to community banking, financial services, and the changing customer expectations developers now face.

Customer behavior is changing. Expectations are shifting. Technology is accelerating this shift as it acts to alter traditional relationships with our customers as well as the traditional sources of revenue, growth, retention, and customer loyalty. We are moving away from a personal banking relationship to one where the primary relationship is that of utility. Banking becomes something you do through an application, not something you do in a defined location. And those applications better be well designed, because the banking model itself is in jeopardy.

What inspires your teams to innovate and iterate? Why are we not seeing more radical changes in financial application design? While we are still only in the middle stages of this digital transformation, the majority of banks seem destined to be left behind. With the variety of experiences available today, what can we learn from changes in design and customer behavior? What is the role of financial data and identity in this change, and how do we make the concept of big data become a personalized, more meaningful small data experience? If our experience design process were more like Apple, Amazon, Google, or Facebook, what would that look like? Where else should we look for inspiration?